Retirement Tax Strategies That Help Your Money Last Longer

Recent tax changes have created new retirement planning considerations. In this educational webinar, we explore how Roth conversions, required minimum distributions, and income timing decisions can influence long-term flexibility and tax efficiency.

Big Tax Changes, Smart Planning Moves: What You Need to Know Now

This isn’t just another tax update. It’s a strategy session for retirees, near-retirees, and planners who want to make the most of 2025’s new rules before they disappear.

Budgeting Isn’t a Four-Letter Word: Planning Your Cash Flow with Confidence

Rethink budgeting with a fresh approach that puts you in control of your cash flow—without stress, guilt, or giving up your favorite latte. Join us for a practical, upbeat webinar that makes planning your money feel empowering—not punishing.

Through the Noise: Retiring with Confidence in a Volatile Market

Retiring in a volatile market doesn’t have to feel overwhelming. Join us to learn how to cut through the noise, manage emotions, and build a retirement income plan that keeps you grounded—no matter what the market throws your way.

Taxes Made Simple: Smart Strategies for Retirees

Discover smart, simple strategies for navigating retirement taxes. In this webinar, we’ll break down recent tax law changes, explore tax-efficient withdrawals, and uncover hidden deductions to help safeguard your financial future.

Love Your Legacy: Secure Your Family’s Future

Take charge of your financial legacy. Join our webinar to explore actionable strategies for legacy planning, securing your loved ones’ financial future, and understanding the key elements of estate planning, including wills and trusts

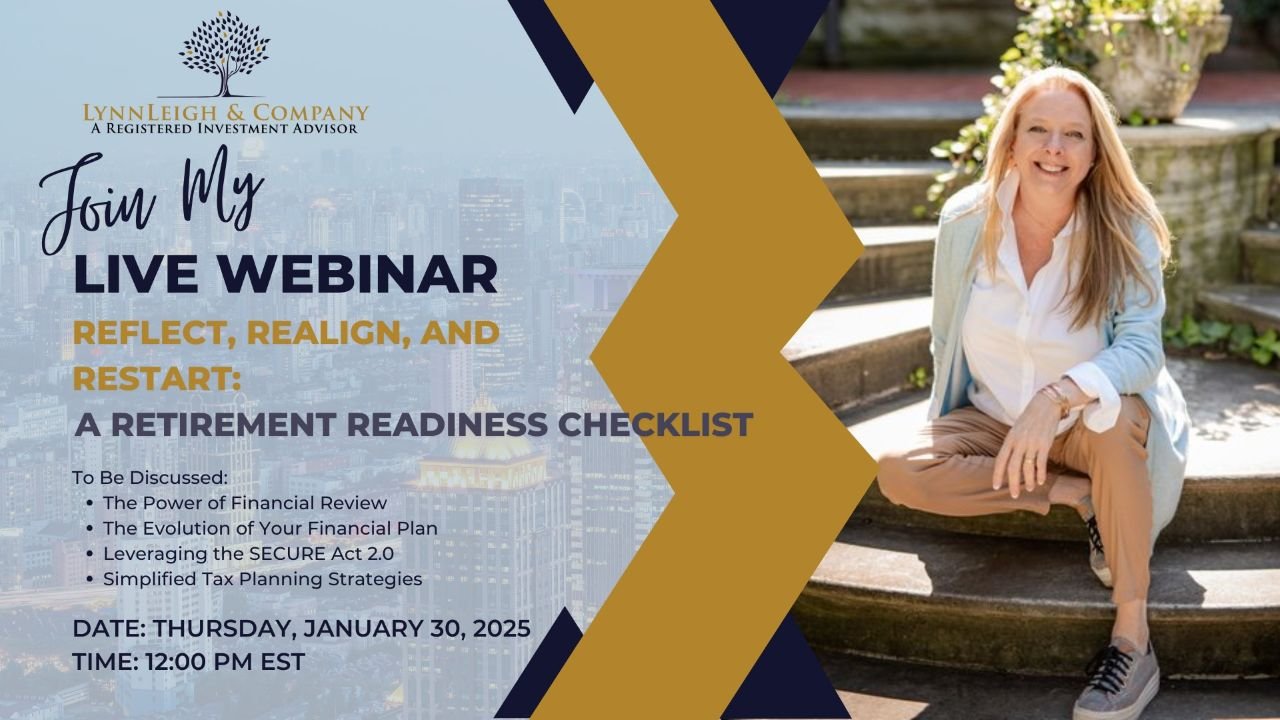

Reflect, Realign and Restart: A Retirement Readiness Checklist

Set the stage for a confident 2025 with our 'Reflect, Realign, and Restart' webinar. Learn how to evaluate your retirement progress, adapt to life changes, optimize tax strategies, and make the most of new opportunities under the SECURE 2.0 Act.

Stay Healthy, Stay Wealthy: Building A Healthcare Budget for Retirement

Join our webinar to learn how to effectively budget for healthcare in retirement. Master Medicare, plan for non-covered expenses, and protect your finances against rising healthcare costs.

Retirement Readiness: Avoiding the Pitfall of Underestimating Your Income Needs

Planning for retirement can be complex, but underestimating your income needs can have a profound impact. Join us for our upcoming webinar, Retirement Readiness: Avoiding the Pitfall of Underestimating Your Income Needs, to gain insights into how you can accurately plan for a financially secure retirement.

Beyond Basics: Comprehensive Cybersecurity Through Mindsets

In an increasingly digital world, safeguarding your personal and financial information is more crucial than ever. Join us for our "Beyond Basics: Comprehensive Cybersecurity Through Mindsets" workshop, where we'll dive deep into advanced strategies and mindset shifts that can help you protect yourself from the ever-evolving landscape of cyber threats. This workshop is designed for those who want to go beyond basic security measures and build a robust defense against potential risks.

Beyond Just a Will: Comprehensive Estate Planning

At LynnLeigh & Company, we believe estate planning goes beyond drafting a simple will. Our "Beyond Just a Will: Comprehensive Estate Planning" workshop empowers you to take control of your financial legacy. Learn how to protect your loved ones, minimize taxes, and ensure your wishes are honored with a plan tailored to your unique needs. Join us to explore essential strategies that provide peace of mind for you and your family.

A Parent's Guide to Education Savings: Navigating The Path to Your Child's Educational Future.

Navigating the complexities of education savings can be daunting for any parent. At LynnLeigh & Company, our workshop, "A Parent's Guide to Education Savings: Navigating the Path to Your Child's Educational Future," is designed to equip you with the knowledge and tools to make informed decisions about your child's educational funding. From understanding different savings vehicles to strategic planning tips, our expert-led session will empower you to secure your child's academic future with confidence.