Budgeting Isn’t a Restriction—It’s a Release

Why a values-based retirement budget is the ultimate tool for financial freedom

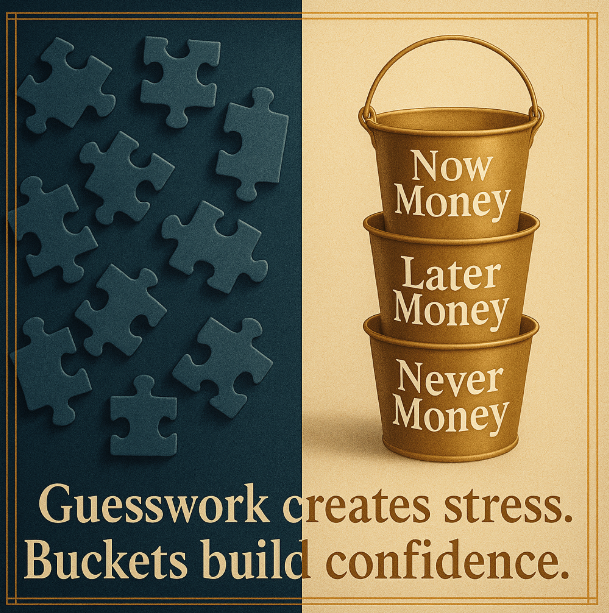

Most people hear the word budget and immediately think of restrictions. But what if budgeting, especially in retirement, was the exact opposite?

Let me introduce you to Jamie and Ann.

Jamie entered retirement with a “hope for the best” mindset. He knew roughly what he had saved, but he didn’t have a plan. He avoided budgeting because it felt limiting—like a list of things he couldn’t do.

Ann, on the other hand, took a more intentional approach. She worked with a financial advisor to build a values-based retirement budget—one that made room for what mattered most to her: travel, time with grandkids, giving back to her community, and prioritizing her health.

The difference?

When life threw surprises her way (because retirement still has curveballs), Ann adjusted with clarity and confidence. Jamie? He panicked. He felt out of control, unsure if he was overspending—or being too frugal.

Retirement Doesn't Require a Fortune—It Requires a Plan

You don’t need millions to feel financially free. What you do need is a flexible, well-designed spending plan that aligns with your lifestyle, goals, and values.

A recent Schwab study found that only 33% of Americans have a written financial plan—but those who do are:

More confident in their decisions

Less stressed about money

More likely to reach their financial goals

That’s the power of purposeful planning.

Your Budget Should Reflect Your Joy—Not Just Your Bills

A well-crafted retirement budget isn’t a leash. It’s a map. It helps you spend freely within the bounds of what’s possible—and in alignment with what brings you joy.

It’s not about what you can’t do—it’s about making the most of what you can.

Takeaway:

A budget done right is an act of self-trust. It’s how you honor your values, your freedom, and your future.

Ready to Create Your Freedom Budget?

At LynnLeigh & Co, we help you build retirement plans that reflect who you are—not just what you’ve saved.

Let’s create a path that’s empowering, flexible, and grounded in what matters most.

LynnLeigh & Company - A Registered Investment Advisor This information is provided by LynnLeigh & Co. for general information and educational purposes based upon publicly available information from sources believed to be reliable – LynnLeigh & Co. advisors cannot assure the accuracy or completeness of these materials. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. The information in these materials may change at any time and without notice. Past performance is not a guarantee of future returns.

What Our Clients Are Reading