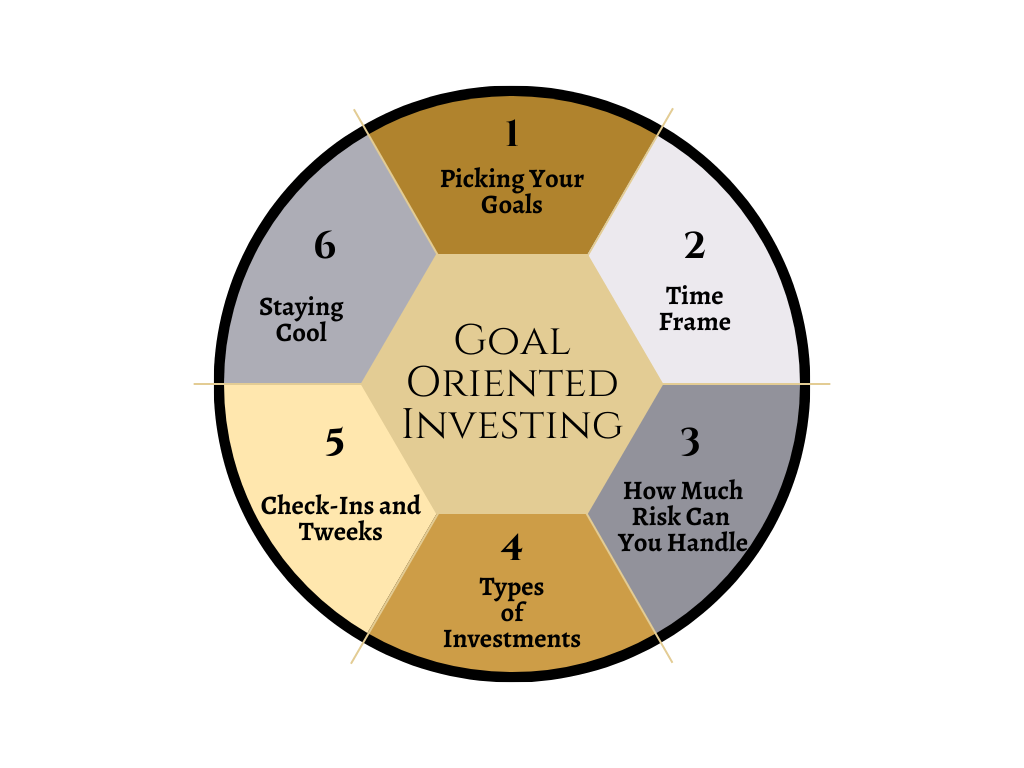

Goal-Oriented Investing

Goal-oriented investing is like setting up a personal game plan for your money, making sure it's working hard towards the things you want in life, like a new home, retirement, or college for the kids. Here's the lowdown on how it works:

Picking Your Goals: Think about what you want to achieve. Maybe it's a beach house, a dream wedding, or a cushy retirement. You name it!

Time Frame: Each goal has its own countdown timer. Saving for a vacation in 2 years is a short-term goal, while planning for retirement is a long game.

How Much Risk Can You Handle?: Some people are cool with rollercoaster markets, while others prefer a chill ride. Figure out where you stand for each of your goals.

Mixing it Up: Don't put all your eggs in one basket. Spread your money across different types of investments like stocks, bonds, or real estate, depending on how soon you need the cash and how gutsy you're feeling.

Check-ins and Tweaks: Markets change and so might your goals. Regularly checking your investments lets you tweak things to stay on track.

Staying Cool: Having a plan helps you stick to your goals and not freak out with every market dip or spike. It's about playing the long game and not getting sidetracked by the market's mood swings.

Basically, goal-oriented investing is about making your money march to the beat of your life's plans. It's a strategy to help you stay focused, dodge unnecessary risks, and keep your eyes on the prize!